GLUTEN-FREE CHEESE BREAD!

Here is a GREAT recipe from one of my clients Claudine Pender, owner of Restory in North Vancouver. This recipe was originally published here.

BECAUSE CHEESE IS ALWAYS A GOOD IDEA.

I am excited to share with you this recipe! EVERYBODY asks me about it… My friends, and their friends… and I have texted and emailed and bragged about it… LOL!

I used to have an OLD recipe that did not seem to work the same every time I made it, so I looked into my books and finally found one recipe that worked!!!!

Without further ado… here it is!!!

Preheat over to 400F.

Ingredients:

- 2 cups of tapioca starch

- 1 1/2 cups of grated parmesan cheese

- 1 egg

- 1 tbsp oil

- 1 tbsp margarine

- 1 cup of warm milk

Step by step!

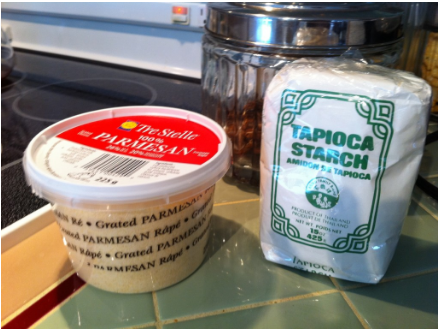

2 CUPS OF TAPIOCA STARCH

1 1/2 CUPS OF GRATED PARMESAN CHEESE

THIS WHAT I USED

MARGARINE, OIL, AND EGG

Ok, so put the 2 cups of Tapioca and the 1 1/2 of Parmesan in a bowl. Make kind of a “well” in the middle, and add 1 tbsp of margarine, 1 tbsp oil (any oil, I used Grape seed, but have used canola and olive oil before) and whole egg.

In the meantime, heat 1 cup of milk in the microwave (I heated 1 cup of milk for 1 minute and it was perfect).

Slowly, mix from the little “well” outwards, trying to incorporate the tapioca into the wet ingredients. Add the milk slowly.

It will probably not take the whole cup.

INCORPORATE THE WET INGREDIENTS

Work on it from inside outwards until it forms a dough.

The consistency is kind of strange, if you never worked with Tapioca starch before… it kinds of works against you, but you keep

doing it until you don’t see anymore white Tapioca. Remember you will have some milk left over.

Make little balls – I make them bite size, with a small tea spoon – you can make them bigger. This recipe yields 40 little ones. You can double the recipe and works very well.

Bake it at 400F pre -heated oven, for 15-20 min. They will rise a little bit.

I use parchment paper on the baking sheet, you can grease the baking sheet if you don’t have parchment paper handy.

HOT AND READY!

These are AWESOME while hot, but the next day they will be dry and chewy. You can warm up in the microwave, but I prefer to just

bake small batches. So you can freeze them and bake as you need it. Freeze them on the baking sheet before baking. Then transfer the little balls to a ziploc bag.

Please share this recipe with everybody you know cannot eat gluten!

Cheers,

Claudine

SHARE THIS ARTICLE

RECENT POSTS