SABEENA BUBBER

MORTGAGE BROKER | AMP

Sabeena Bubber is a nationally recognized Mortgage Broker with Xeva Mortgage, bringing over 30 years of experience in consumer mortgage and finance. In 2025, she was honoured as Mortgage Broker of the Year for both Western Canada and all of Canada, a testament to her commitment to excellence. Over her career, she has funded more than $1 billion in mortgages for over 3,000 clients.

Her achievements include the 2025 Mortgage Broker of the Year (Canada), 2025 Mortgage Broker of the Year (Western Canada), 2019 CMBABC Community Service Award, 2019 Excellence in Philanthropy and Community Service Award, recognition as a Woman of Influence, CMP Top 75 Mortgage Broker in Canada, and induction into the CMP Hall of Fame.

Beyond professional success, Sabeena is deeply committed to giving back. She founded Brokers Who Care, a nationwide group of mortgage professionals who pool resources to support families in crisis, donating over half a million dollars to date. She also created The Divorce Circle, a platform providing education, resources, and community to individuals navigating separation. Recognizing the overwhelming complexities of divorce, she developed a trusted space where people can learn about their process options, build their “Divorce Team,” and find guidance on housing and real estate needs post-divorce.

What sets Sabeena apart is her dedication to clients’ long-term success. She does more than secure interest rates—she deciphers fine print, structures tailored solutions, and builds enduring relationships. While she is happy to arrange a single mortgage, her passion lies in being a lifelong financial guide, helping clients make smart, informed decisions at every stage.

On a personal note, Sabeena is a proud mother of two daughters who are the centre of her world. A divorced parent herself, she understands the challenges many clients face and approaches her work with empathy and care. She is also a breast cancer survivor whose resilience has shaped her outlook on life. Passionate about personal growth, she studies NLP, hypnotherapy, and the teachings of Dr. Joe Dispenza, continually seeking to expand her knowledge and impact.

At her core, Sabeena’s mission is simple yet profound: to make a positive and lasting difference in the lives of those she meets—through mortgages, mentorship, community service, and compassion.

My Process is Simple

STEP ONE

Start the conversation.

The best place to start is to connect with me directly. The mortgage process is personal, and it can be daunting. My commitment to you is that I'll listen to all your needs, assess your financial situation, and provide you with a plan to move forward.

STEP TWO

Discover the best option.

Once we’ve had a look at your financial situation, we’ll consider a variety of mortgage options, I’ll outline what documents are necessary to qualify for a mortgage, negotiate with the lenders on your behalf, and arrange the mortgage that best suits your needs.

STEP THREE

Sit back and relax.

Once we’ve arranged the mortgage product that best suits your needs, you’re not alone. I’m your mortgage professional for life. If you’ve got questions in the years to come, I’m always available to make sure that your mortgage is working FOR you, and not the other way around!

Videos

Visit my videos page for more helpful information.

Getting a mortgage shouldn't be confusing. I'll guide you through it.

Mortgage Services

Know the right mortgage product for your circumstance.

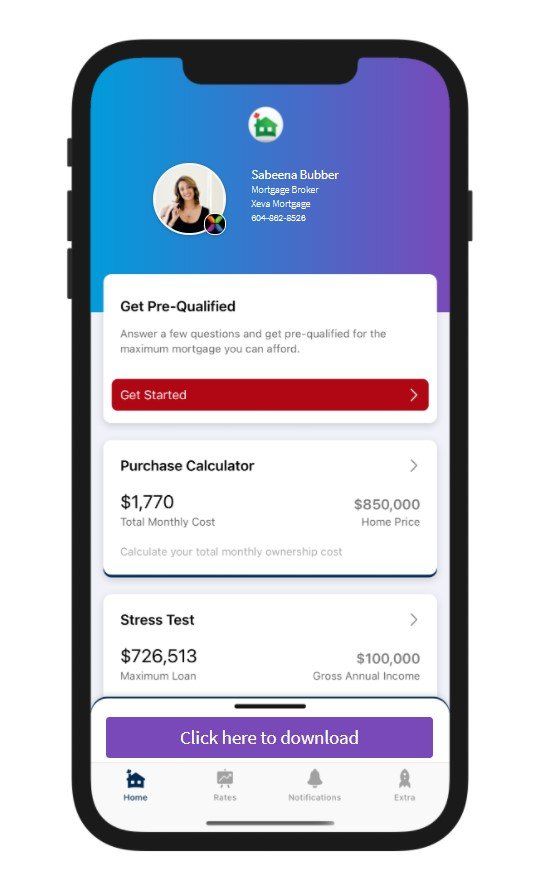

Download my Mortgage Toolbox

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

Looking to run some numbers?

If you're going through a divorce

and need mortgage advice.

You don't have to suffer in private,

you're not alone on this journey.

Visit my dedicated site for those navigating separation and divorce.

Access free resources and expert guidance to help you through this transition.

55+ and looking for solutions to enhance your lifestyle?

Would you rather just get down to it and have me tell you exactly how much you qualify for?

Articles

I keep my Articles up to date so you can stay informed.